As the United States economy continues to navigate post-pandemic challenges, a new report reveals that personal debt has reached unprecedented levels, potentially signaling trouble for both individual households and the broader economy.

According to data released by the Federal Reserve, total household debt in the U.S. climbed to a staggering $17.5 trillion in the second quarter of 2024, marking a 3.6% increase from the same period last year. This surge in personal debt has economists and policymakers alike pondering its implications for America’s financial future.

Breaking Down the Debt

The composition of this massive debt burden offers insight into the financial pressures facing American households:

- Mortgage Debt: Accounting for the lion’s share at 68% of total household debt, mortgage loans now stand at $11.9 trillion. While this reflects a robust housing market, it also raises concerns about affordability and potential vulnerabilities to interest rate fluctuations.

- Student Loans: At $1.9 trillion, or 11% of total debt, student loans continue to be a significant burden, especially for younger generations. The looming resumption of federal student loan payments after a pandemic-induced pause is expected to add further strain to many households.

- Auto Loans: Representing 10% of the debt pie at $1.75 trillion, auto loans have been impacted by rising interest rates and increasing vehicle prices, making car ownership more expensive for many Americans.

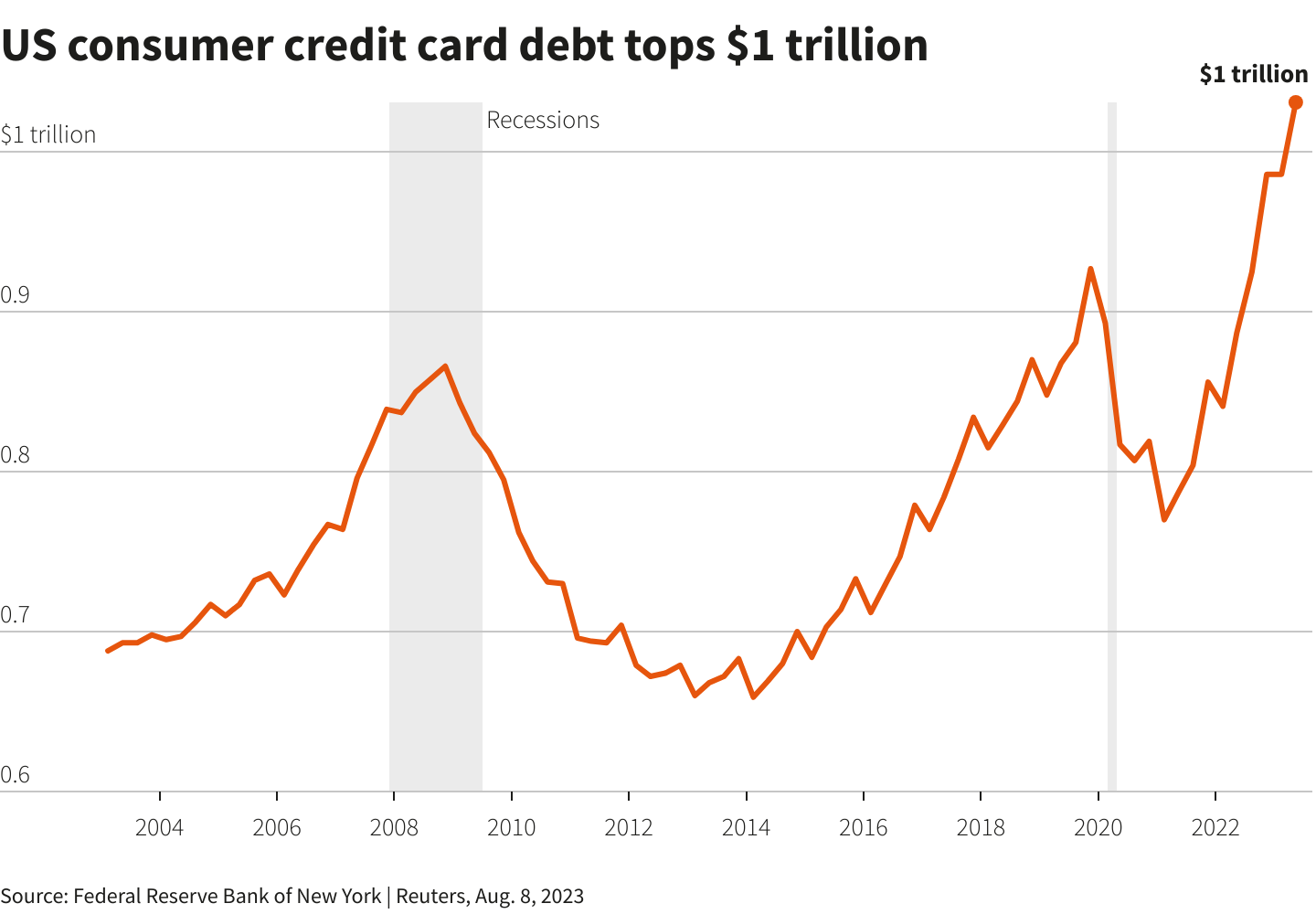

- Credit Card Debt: Perhaps most alarmingly, credit card debt has surged to $1.4 trillion, an 8.5% year-over-year increase. With average interest rates exceeding 20%, this high-cost debt is particularly concerning for financial experts.

Rising Delinquencies: A Red Flag?

While debt levels alone are not necessarily indicative of financial distress, rising delinquency rates across all debt categories are sounding alarm bells. The overall delinquency rate has increased to 2.9%, up from 2.5% a year ago. Credit card delinquencies have seen the most significant jump, with 4.6% of balances now 90 days or more past due.

Dr. Emily Chen, an economist at Capital University, notes, “The uptick in delinquencies, particularly in high-interest debt like credit cards, suggests that many households are struggling to keep up with their financial obligations. This could be a leading indicator of broader economic stress.”

Demographic Disparities

The burden of debt is not evenly distributed across the population. Lower-income households, millennials, and Gen Z are facing disproportionately high debt-to-income ratios. This generational divide in debt burden could have long-lasting effects on wealth accumulation and economic mobility.

Economic Implications and Policy Considerations

As personal debt continues to rise, its impact on consumer spending—a key driver of economic growth—becomes a critical concern. High debt levels may constrain future spending, potentially slowing economic growth in sectors heavily reliant on consumer activity.

In response to these challenges, policymakers are considering a range of interventions:

- Enhanced financial literacy programs to improve consumer decision-making

- Debt relief initiatives, particularly for student loans

- Stricter regulation of lending practices to protect vulnerable borrowers

John Martinez, a senior policy advisor at the Consumer Financial Protection Bureau, emphasizes the need for a balanced approach: “While access to credit is crucial for economic growth, we must ensure that borrowing remains sustainable. This may require a combination of consumer protections, financial education, and targeted relief programs.”

As America grapples with this complex debt landscape, the coming months will be critical in determining whether current trends represent a manageable phase of economic growth or a prelude to more significant financial challenges. What’s clear is that the nation’s relationship with debt will continue to shape its economic trajectory for years to come.